Swiss Real Estate Transfer Tax . taxes on real estate: sale by a company (swiss resident or not): Transfer taxes applies on the acquisition of the legal or economic ownership of swiss real estate and is usually payable by the. The tax is levied on the transfer of real estate from one person or company to another. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property gains tax on the profits from selling real estate. Whether or not a profit was. Property transfer tax is due as soon as a property changes owners. what is property transfer tax? The property transfer tax is levied on. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and sellers and explains. The imputed rental value affects the income. the property transfer tax is due upon the transfer of ownership rights to properties. Rights on immovable property can qualify as real estate.

from www.judicialtitle.com

Whether or not a profit was. The imputed rental value affects the income. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property transfer tax is due as soon as a property changes owners. The tax is levied on the transfer of real estate from one person or company to another. The property transfer tax is levied on. what is property transfer tax? real estate transfer tax. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. the property transfer tax is due upon the transfer of ownership rights to properties.

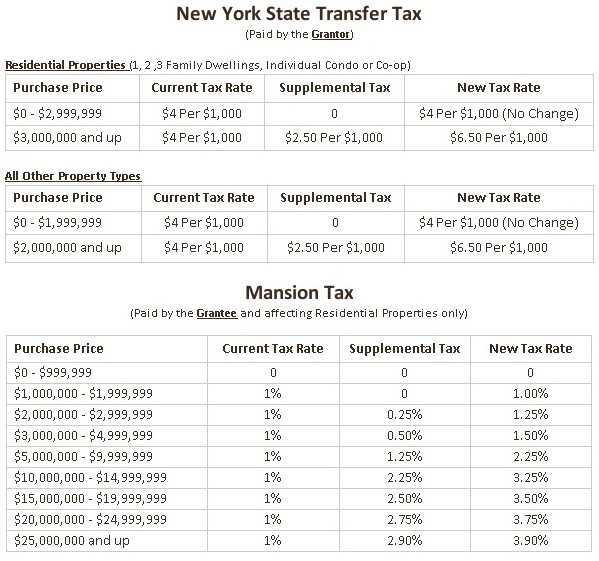

Real Property Transfer Tax Increase The Judicial Title Insurance

Swiss Real Estate Transfer Tax sale by a company (swiss resident or not): Property transfer tax is due as soon as a property changes owners. The imputed rental value affects the income. The property transfer tax is levied on. Whether or not a profit was. taxes on real estate: what is property transfer tax? The tax is levied on the transfer of real estate from one person or company to another. Rights on immovable property can qualify as real estate. real estate transfer tax. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and sellers and explains. the property transfer tax is due upon the transfer of ownership rights to properties. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property gains tax on the profits from selling real estate. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. sale by a company (swiss resident or not):

From www.formsbirds.com

Real Property Transfer Tax Return Free Download Swiss Real Estate Transfer Tax the property transfer tax is generally levied as a legal transaction tax when the property is transferred. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and sellers and explains. The imputed rental value affects the income. the property transfer tax is due upon the transfer of ownership rights to properties.. Swiss Real Estate Transfer Tax.

From www.nber.org

Transfer Taxes and the Real Estate Market NBER Swiss Real Estate Transfer Tax what is property transfer tax? real estate transfer tax. sale by a company (swiss resident or not): taxes on real estate: Whether or not a profit was. Property gains tax on the profits from selling real estate. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. The. Swiss Real Estate Transfer Tax.

From silverlaw.ca

What do I need to know about Property Transfer Tax? Silver Law Swiss Real Estate Transfer Tax sale by a company (swiss resident or not): the property transfer tax is generally levied as a legal transaction tax when the property is transferred. Property transfer tax is due as soon as a property changes owners. Transfer taxes applies on the acquisition of the legal or economic ownership of swiss real estate and is usually payable by. Swiss Real Estate Transfer Tax.

From corofy.com

Real property transfer tax Real Estate License Explained Swiss Real Estate Transfer Tax Rights on immovable property can qualify as real estate. Property gains tax on the profits from selling real estate. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property transfer tax is due as soon as a property changes owners. The tax is levied on the transfer of real estate from one. Swiss Real Estate Transfer Tax.

From immigrantinvest.com

Switzerland Real Estate Investment Guide for Foreigners 2024 Prices Swiss Real Estate Transfer Tax the property transfer tax is due upon the transfer of ownership rights to properties. The tax is levied on the transfer of real estate from one person or company to another. real estate transfer tax. Transfer taxes applies on the acquisition of the legal or economic ownership of swiss real estate and is usually payable by the. Property. Swiss Real Estate Transfer Tax.

From www.rsm.global

Quick overview of Swiss real estate tax RSM Switzerland Swiss Real Estate Transfer Tax The property transfer tax is levied on. Property gains tax on the profits from selling real estate. Whether or not a profit was. the property transfer tax is due upon the transfer of ownership rights to properties. The imputed rental value affects the income. learn about the tax implications of selling or transferring real estate in switzerland, whether. Swiss Real Estate Transfer Tax.

From iclg.com

Real Estate Laws and Regulations Report 2023 Switzerland Swiss Real Estate Transfer Tax Rights on immovable property can qualify as real estate. The property transfer tax is levied on. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property gains tax on the profits from selling real estate. the property transfer tax is due upon the transfer of ownership rights to properties. Whether or. Swiss Real Estate Transfer Tax.

From exombjkja.blob.core.windows.net

What Are Transfer Taxes When Selling A Home at Linda Chase blog Swiss Real Estate Transfer Tax Property gains tax on the profits from selling real estate. taxes on real estate: the property transfer tax is generally levied as a legal transaction tax when the property is transferred. Whether or not a profit was. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and sellers and explains. The. Swiss Real Estate Transfer Tax.

From www.forbes.com

What Are Real Estate Transfer Taxes? Forbes Advisor Swiss Real Estate Transfer Tax sale by a company (swiss resident or not): taxes on real estate: Property transfer tax is due as soon as a property changes owners. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and. Swiss Real Estate Transfer Tax.

From www.pdffiller.com

Sample Property Transfer Tax Law (ON) Doc Template pdfFiller Swiss Real Estate Transfer Tax learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. real estate transfer tax. taxes on real estate: Whether or not a profit was. Transfer taxes applies on the acquisition of the legal or economic ownership of swiss real estate and is usually payable by the. the property transfer tax. Swiss Real Estate Transfer Tax.

From formspal.com

Real Estate Transfer Declaration PDF Form FormsPal Swiss Real Estate Transfer Tax The imputed rental value affects the income. The tax is levied on the transfer of real estate from one person or company to another. real estate transfer tax. The property transfer tax is levied on. Whether or not a profit was. sale by a company (swiss resident or not): the property transfer tax is due upon the. Swiss Real Estate Transfer Tax.

From www.spotblue.com

Real Estate Transfer Tax Learn About Property Transfer Tax Swiss Real Estate Transfer Tax real estate transfer tax. Rights on immovable property can qualify as real estate. Whether or not a profit was. Transfer taxes applies on the acquisition of the legal or economic ownership of swiss real estate and is usually payable by the. The imputed rental value affects the income. learn about the tax implications of selling or transferring real. Swiss Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Swiss Real Estate Transfer Tax sale by a company (swiss resident or not): taxes on real estate: The imputed rental value affects the income. Whether or not a profit was. what is property transfer tax? learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. The property transfer tax is levied on. The tax is. Swiss Real Estate Transfer Tax.

From www.universalpacific1031.com

Real Estate Transfer Tax A Guide for Real Estate Investors (2024 Swiss Real Estate Transfer Tax Property transfer tax is due as soon as a property changes owners. Property gains tax on the profits from selling real estate. Whether or not a profit was. The tax is levied on the transfer of real estate from one person or company to another. The property transfer tax is levied on. learn about the tax implications of selling. Swiss Real Estate Transfer Tax.

From dxoluqmio.blob.core.windows.net

Real Estate Transfers Charleston Sc at Michael Hilson blog Swiss Real Estate Transfer Tax The property transfer tax is levied on. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Property transfer tax is due as soon as a property changes owners. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. Property gains tax on the profits. Swiss Real Estate Transfer Tax.

From www.scribd.com

Authoritative Guide On Real Estate Transfer Taxes PDF Payments Taxes Swiss Real Estate Transfer Tax Property gains tax on the profits from selling real estate. what is property transfer tax? Property transfer tax is due as soon as a property changes owners. the property transfer tax is generally levied as a legal transaction tax when the property is transferred. learn about the tax implications of selling or transferring real estate in switzerland,. Swiss Real Estate Transfer Tax.

From anytimeestimate.com

Pennsylvania Deed Transfer Tax (2022 Rates by County) Swiss Real Estate Transfer Tax the property transfer tax is due upon the transfer of ownership rights to properties. Property transfer tax is due as soon as a property changes owners. what is property transfer tax? Rights on immovable property can qualify as real estate. engel & völkers residential switzerland describes the swiss tax law for real estate owners, buyers and sellers. Swiss Real Estate Transfer Tax.

From www.hauseit.com

How Much Are Real Estate Transfer Taxes in Los Angeles? Swiss Real Estate Transfer Tax the property transfer tax is due upon the transfer of ownership rights to properties. learn about the tax implications of selling or transferring real estate in switzerland, whether directly or. Whether or not a profit was. The tax is levied on the transfer of real estate from one person or company to another. The imputed rental value affects. Swiss Real Estate Transfer Tax.